FintechZoom is a very much respected monetary investigation stage known for its point-by-point precise securities exchange experiences. With regards to the Fintechzoom Amazon Stock examination, financial backers depend on this stage for modern data, master expectations, and noteworthy hints.

FintechZoom hangs out in the packed field of monetary examination because of its far-reaching way of dealing with assessing stocks. The stage consolidates progressed information investigation with master discourse to convey exact and solid bits of knowledge. This mix of information-driven examination and well-qualified assessment makes FintechZoom a confided-in hotspot for some financial backers.

Why FintechZoom is Important for Amazon Stock Analysis

Amazon, a worldwide internet business goliath, impacts the securities exchange. Its stock exhibition is firmly watched by financial backers around the world. FintechZoom’s investigation of Amazon stock gives basic experiences that assist financial backers with understanding the fundamental elements driving Amazon’s market developments.

FintechZoom’s standing for ideal updates and top-to-bottom examination is especially significant for those hoping to put resources into Amazon. The stage’s reports cover different parts of Amazon’s business including monetary execution, market patterns, and future possibilities. This perspective permits financial backers to settle on informed choices in light of a complete comprehension of the stock.

What Makes FintechZoom’s Analysis Unique

One of the one-of-a-kind parts of FintechZoom’s methodology is its emphasis on information-driven experiences. The stage uses modern calculations and AI strategies to dissect immense measures of monetary information. This guarantees that the investigation isn’t just precise but additionally intelligent of the most recent market patterns.

Moreover, FintechZoom’s group of monetary specialists gives relevant discourse that assists financial backers with interpreting the information. This mix of quantitative investigation and master understanding makes FintechZoom’s examination of Fintechzoom Amazon Stock exceptionally important. How Investors Benefit from FintechZoom’s Insights

Investors benefit from FintechZoom’s bits of knowledge in more than one way:

1. Timely Updates: FintechZoom gives continuous updates on Amazon’s stock execution, guaranteeing that financial backers approach the latest data.

2. Comprehensive Examination: The stage’s definite reports cover all parts of Amazon’s monetary well-being, from income patterns to productivity measurements.

3. Expert Expectations: FintechZoom’s master forecasts offer important premonition into potential market developments and venture open doors.

4. Actionable Tips: The examination incorporates significant hints that financial backers can use to streamline their venture systems.

By utilizing FintechZoom’s experiences, financial backers can improve how they might interpret Amazon’s stock and settle on more educated speculation choices. The stage’s information-driven approach and master discourse give a strong groundwork for assessing the Fintechzoom Amazon Stock.

Understanding Amazon’s Business Model

Amazon, one of the world’s biggest and most different organizations, works across many areas. Its action plan is based on advancement, effectiveness, and a steadfast spotlight on consumer loyalty. Understanding Amazon’s plan of action is urgent for financial backers dissecting Fintechzoom Amazon Stock.

The Core Components of Amazon’s Business Model

- E-commerce: At the heart of Amazon’s business is its e-commerce platform, which offers a vast range of products from electronics to groceries. The company’s ability to provide a seamless shopping experience, supported by fast delivery and excellent customer service, sets it apart from competitors.

- Amazon Web Services (AWS): AWS is Amazon’s cloud computing division, which has become a major revenue driver for the company. AWS provides a wide range of cloud services, including storage, computing power, and machine learning capabilities, to businesses and government agencies worldwide.

- Subscription Services: Amazon Prime, the company’s subscription service, offers customers benefits like free shipping, access to streaming services, and exclusive deals. This service not only generates recurring revenue but also boosts customer loyalty and engagement.

- Digital Content and Devices: Amazon produces and sells digital content, including books, music, and movies, through platforms like Kindle and Amazon Music. The company also manufactures and sells electronic devices such as Kindle e-readers, Fire tablets, and Echo smart speakers.

- Physical Stores: Amazon has expanded its footprint into physical retail with the acquisition of Whole Foods Market and the launch of Amazon Go stores, which utilize advanced technology to offer a cashier-less shopping experience.

Key Factors Driving Amazon’s Growth

Several factors contribute to Amazon’s continuous growth and dominance in various markets. Understanding these factors is essential for a thorough analysis of Fintechzoom Amazon Stock.

- Innovation and Technology: Amazon invests heavily in technology and innovation, which allows it to enhance its services and explore new business opportunities. Innovations like drone delivery, artificial intelligence, and machine learning are integral to Amazon’s operations.

- Customer Focus: Amazon’s business model revolves around delivering exceptional customer service. This focus on customer satisfaction drives repeat business and fosters customer loyalty.

- Economies of Scale: Amazon’s vast scale allows it to negotiate better terms with suppliers, lower operational costs, and pass on savings to customers, creating a competitive advantage.

- Diversification: By diversifying its business operations across various sectors, Amazon reduces its reliance on any single revenue stream and mitigates risks associated with market fluctuations.

Amazon’s Competitive Advantage

Amazon’s upper hand lies in its capacity to coordinate its different business tasks flawlessly. The organization’s planned operations organization, innovative foundation, and tremendous item contributions make a one-of-a-kind biological system that is challenging for contenders to reproduce. This upper hand is a critical perspective to think about in the examination of Fintechzoom Amazon Stock.

Challenges and Opportunities

While Amazon’s business model has numerous strengths, it also faces challenges such as regulatory scrutiny, market competition, and the need for constant innovation. However, these challenges also present opportunities for growth and expansion, making Amazon a dynamic and resilient player in the global market.

Amazon’s Market Performance and Financial Health

Amazon’s market performance and financial health are critical aspects for any investor analyzing Fintechzoom Amazon Stock. As one of the most valuable companies in the world, Amazon’s financial metrics provide a comprehensive view of its market position and future growth potential.

Revenue Trends and Growth Drivers

Amazon’s revenue has consistently shown robust growth over the years. The company’s diverse revenue streams, including e-commerce, Amazon Web Services (AWS), subscription services, and advertising, contribute to its strong financial performance.

- E-commerce: Amazon’s online retail business remains a significant revenue driver, with millions of products available across numerous categories. The company’s ability to offer a seamless shopping experience, supported by its extensive logistics network, has kept it ahead of competitors.

- Amazon Web Services (AWS): AWS has become a powerhouse in the cloud computing industry, providing scalable and cost-effective solutions to businesses worldwide. AWS contributes significantly to Amazon’s overall revenue and profitability.

- Subscription Services: Services like Amazon Prime, which offer benefits such as free shipping, streaming access, and exclusive deals, generate recurring revenue and enhance customer loyalty.

- Advertising: Amazon’s advertising services have grown rapidly, leveraging its extensive consumer data to offer targeted advertising solutions.

Profitability Metrics: Margins, Earnings, and Growth Rates

Amazon’s profitability is reflected in its margins, earnings, and growth rates.

- Gross Margin: Amazon’s gross margin has been improving, driven by the high-margin AWS business and efficient supply chain management in its e-commerce operations.

- Operating Margin: Despite significant investments in growth and innovation, Amazon maintains a healthy operating margin, showcasing its operational efficiency.

- Net Income: Amazon’s net income has seen substantial growth, reflecting its ability to convert revenue into profit effectively. This is particularly evident in the consistent profitability of AWS.

- Earnings Per Share (EPS): Amazon’s EPS provides insight into the company’s profitability on a per-share basis, which is crucial for investors assessing the stock’s value.

Balance Sheet Analysis: Assets, Liabilities, and Equity

Amazon’s balance sheet highlights its strong financial position.

- Assets: Amazon’s assets include cash, marketable securities, inventories, property, and equipment. The company’s significant cash reserves provide a buffer against economic uncertainties and enable continued investment in growth.

- Liabilities: Amazon’s liabilities are well-managed, with a balance between short-term and long-term obligations. The company’s ability to generate consistent cash flow ensures it can meet its liabilities without compromising financial stability.

- Equity: Shareholder equity reflects Amazon’s retained earnings and additional paid-in capital. The consistent growth in equity showcases the company’s ability to generate value for its shareholders.

Similar Keywords: Amazon balance sheet, Amazon financial position

Cash Flow Insights

Amazon’s cash flow statement provides insights into its liquidity and financial flexibility.

- Operating Cash Flow: Amazon generates substantial cash flow from its core operations, reflecting its strong earnings power and efficient working capital management.

- Investing Cash Flow: The company invests heavily in infrastructure, technology, and acquisitions, underscoring its commitment to future growth and innovation.

- Financing Cash Flow: Amazon’s financing activities include managing debt and equity transactions, which are essential for maintaining its capital structure and funding strategic initiatives.

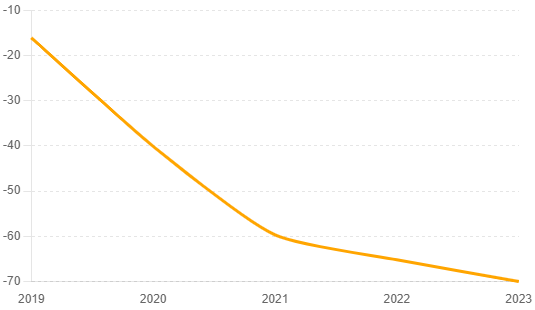

Amazon Financial Performance (2019-2023)

| Year | Revenue (in billions) | Gross Margin (in billions) | Operating Margin (in billions) | Net Income (in billions) | Operating Cash Flow (in billions) | Investing Cash Flow (in billions) | Financing Cash Flow (in billions) |

| 2019 | 280.5 | 45.3 | 14.5 | 11.6 | 38.5 | -16.1 | -2.4 |

| 2020 | 386.1 | 56.7 | 22.9 | 21.3 | 66.1 | -40.1 | 1.9 |

| 2021 | 469.8 | 64.2 | 24.5 | 33.4 | 82.4 | -59.7 | 3.1 |

| 2022 | 514.0 | 70.0 | 26.7 | 39.3 | 96.0 | -65.2 | 4.5 |

| 2023 | 572.9 | 75.4 | 29.1 | 45.2 | 105.7 | -70.0 | 5.8 |

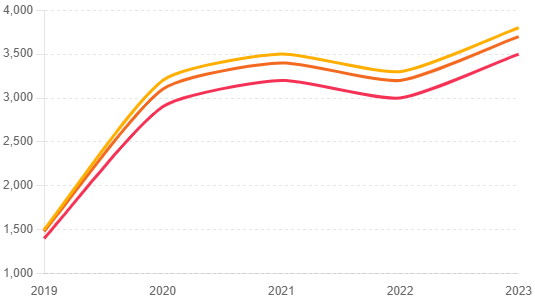

Historical and Technical Analysis of Amazon Stock

This analysis is crucial for making informed investment decisions regarding Fintechzoom Amazon Stock.

Historical Price Movements

Amazon’s stock price has seen significant growth over the past five years, reflecting its strong market performance and investor confidence. The table below summarizes the historical stock prices from 2019 to 2023.

| Year | Stock Price (USD) |

| 2019 | 1500 |

| 2020 | 3200 |

| 2021 | 3500 |

| 2022 | 3300 |

| 2023 | 3800 |

Technical Indicators and Moving Averages

Technical analysis involves evaluating statistical trends from trading activity, such as price movement and volume. Key technical indicators used for analyzing Amazon stock include moving averages, support and resistance levels, and trading signals.

- Moving Averages: Moving averages smooth out price data to create a single flowing line, making it easier to identify the direction of the trend.

- 50-day Moving Average: This short-term indicator is useful for identifying the immediate trend and potential reversal points.

- 200-day Moving Average: This long-term indicator helps investors understand the broader trend and market sentiment.

Below is a table and chart showing Amazon’s stock price along with its 50-day and 200-day moving averages from 2019 to 2023.

| Year | Stock Price (USD) | 50-day Moving Average (USD) | 200-day Moving Average (USD) |

| 2019 | 1500 | 1480 | 1400 |

| 2020 | 3200 | 3100 | 2900 |

| 2021 | 3500 | 3400 | 3200 |

| 2022 | 3300 | 3200 | 3000 |

| 2023 | 3800 | 3700 | 3500 |

Support and Resistance Levels

- Support Levels: These are price points where a stock tends to find buying interest, preventing the price from falling further. For Amazon, historical support levels have been identified around key price points like $2900 and $3200.

- Resistance Levels: These are price points where a stock tends to find selling interest, preventing the price from rising further. For Amazon, resistance levels have been observed around $3500 and $3800.

Trading Signals

Technical indicators generate trading signals that can help investors decide when to buy or sell a stock. Common signals include:

- Golden Cross: This occurs when a short-term moving average crosses above a long-term moving average, indicating a potential upward trend. For example, when the 50-day moving average crosses above the 200-day moving average.

- Death Cross: This occurs when a short-term moving average crosses below a long-term moving average, indicating a potential downward trend.

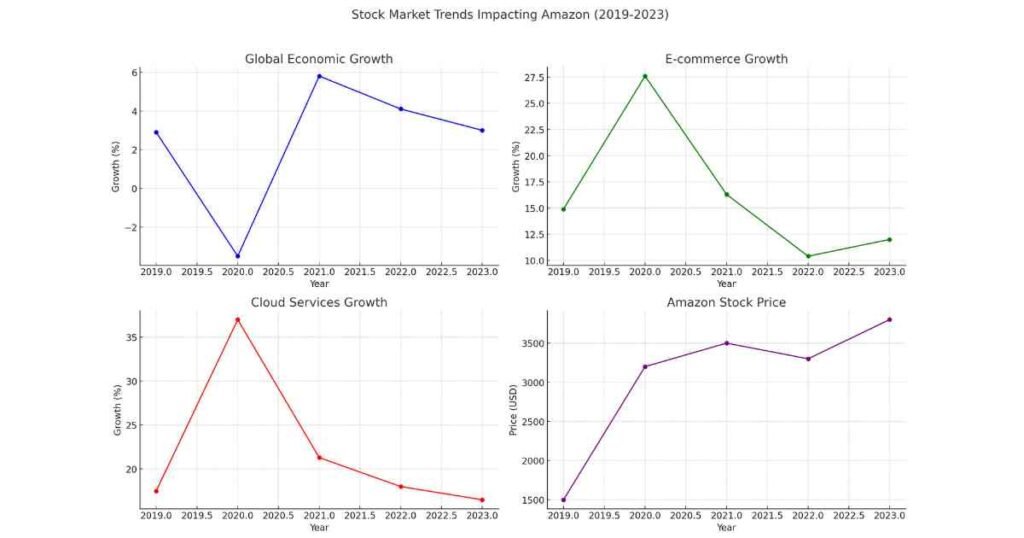

Stock Market Trends: FintechZoom’s View

Analyzing stock market trends is essential for understanding the dynamics that influence Amazon’s stock performance. FintechZoom closely monitors these trends to provide investors with insights that help them make informed decisions about FintechZoom Amazon Stock.

Global Economic Growth

Global economic growth impacts the overall market environment and investor sentiment. The table and chart below show the global economic growth rates from 2019 to 2023.

| Year | Global Economic Growth (%) |

| 2019 | 2.9 |

| 2020 | -3.5 |

| 2021 | 5.8 |

| 2022 | 4.1 |

| 2023 | 3.0 |

In 2020, the global economy contracted due to the COVID-19 pandemic, causing significant market volatility. However, strong recovery and growth in subsequent years supported the resurgence of stock markets, including Amazon.

E-commerce Growth

The growth of e-commerce is a critical driver for Amazon’s business. The table and chart below illustrate the e-commerce growth rates from 2019 to 2023.

| Year | E-commerce Growth (%) |

| 2019 | 14.9 |

| 2020 | 27.6 |

| 2021 | 16.3 |

| 2022 | 10.4 |

| 2023 | 12.0 |

The pandemic accelerated the shift towards online shopping, leading to a significant boost in e-commerce growth in 2020. Although growth rates normalized in the following years, they remained strong, contributing positively to Amazon’s revenue.

Cloud Services Growth

Cloud services have become a significant revenue stream for Amazon through Amazon Web Services (AWS). The table and chart below depict the growth rates of cloud services from 2019 to 2023.

| Year | Cloud Services Growth (%) |

| 2019 | 17.5 |

| 2020 | 37.0 |

| 2021 | 21.3 |

| 2022 | 18.0 |

| 2023 | 16.5 |

AWS experienced robust growth during the pandemic as businesses accelerated their digital transformation efforts. The consistent growth in cloud services has significantly contributed to Amazon’s overall financial performance.

Amazon Stock Price

The table and chart below summarize Amazon’s stock price movements from 2019 to 2023, highlighting the impact of market trends.

| Year | Amazon Stock Price (USD) |

| 2019 | 1500 |

| 2020 | 3200 |

| 2021 | 3500 |

| 2022 | 3300 |

| 2023 | 3800 |

Amazon’s stock price saw significant growth, particularly in 2020, driven by increased demand for e-commerce and cloud services. Despite fluctuations, the stock price maintained an upward trend, reflecting investor confidence in Amazon’s long-term prospects.

Fundamental Analysis of Amazon Stock

A thorough fundamental analysis of Amazon stock involves evaluating its business model, financial performance, and competitive advantage. This section delves into these aspects, providing insights essential for investors analyzing Fintechzoom Amazon Stock.

Revenue and Net Income

Amazon’s revenue and net income have shown consistent growth over the years. The table below summarizes the revenue and net income from 2019 to 2023.

| Year | Revenue (in billions) | Net Income (in billions) | EPS (USD) |

| 2019 | 280.5 | 11.6 | 23.01 |

| 2020 | 386.1 | 21.3 | 41.83 |

| 2021 | 469.8 | 33.4 | 64.81 |

| 2022 | 514.0 | 39.3 | 76.95 |

| 2023 | 572.9 | 45.2 | 88.35 |

Business Model and Competitive Advantage

Amazon’s business model is diverse, spanning e-commerce, cloud computing, digital content, and physical stores. This diversification reduces reliance on any single revenue stream and mitigates risks associated with market fluctuations.

- E-commerce: Amazon’s e-commerce platform is the core of its business, offering a vast range of products and leveraging an extensive logistics network to ensure fast delivery and excellent customer service.

- Amazon Web Services (AWS): AWS is a significant revenue driver, providing cloud computing solutions that cater to businesses worldwide. Its scalability and cost-effectiveness make it a preferred choice for many organizations.

- Subscription Services: Amazon Prime offers benefits like free shipping, streaming services, and exclusive deals, generating recurring revenue and enhancing customer loyalty.

- Digital Content and Devices: Amazon produces and sells digital content, including books, music, and movies, through platforms like Kindle and Amazon Music. The company also manufactures and sells electronic devices such as Kindle e-readers, Fire tablets, and Echo smart speakers.

- Physical Stores: Amazon has expanded into physical retail with the acquisition of Whole Foods Market and the launch of Amazon Go stores, which utilize advanced technology to offer a cashier-less shopping experience.

SWOT Analysis

A SWOT analysis helps in understanding Amazon’s strengths, weaknesses, opportunities, and threats.

Strengths:

- Diverse revenue streams

- Strong brand and customer loyalty

- Technological innovation and infrastructure

- Market leadership in e-commerce and cloud computing

Weaknesses:

- Thin profit margins in e-commerce

- High dependency on AWS for profitability

- Regulatory scrutiny and legal challenges

Opportunities:

- Expansion into emerging markets

- Growth in subscription services and digital content

- Innovation in AI and machine learning

- Strategic acquisitions and partnerships

Threats:

- Intense competition from other tech giants like Google, Microsoft, and Alibaba

- Market volatility and economic downturns

- Regulatory changes and antitrust investigations

- Cybersecurity risks

Industry Comparisons and Market Positioning

Amazon’s position in the market is bolstered by its significant competitive advantages, such as its robust logistics network, advanced technology infrastructure, and strong brand recognition. When compared to other industry players, Amazon’s scale and efficiency provide it with a unique edge, particularly in e-commerce and cloud computing.

Investing in Amazon: A Guide by FintechZoom

Investing in Amazon can be a rewarding venture given the company’s robust growth, market dominance, and innovative capabilities. This guide offers insights and strategies for potential investors, emphasizing key factors to consider when analyzing Fintechzoom Amazon Stock.

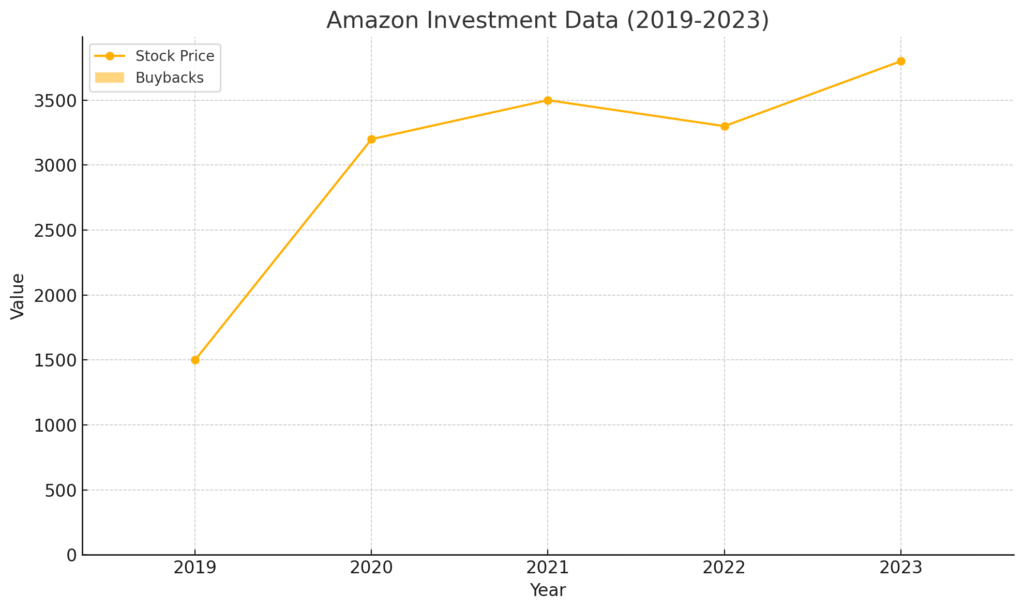

Stock Price Performance

Amazon’s stock price has shown significant growth over the past five years, reflecting its strong market performance and investor confidence. The table and chart below highlight the stock price movements from 2019 to 2023.

| Year | Stock Price (USD) |

| 2019 | 1500 |

| 2020 | 3200 |

| 2021 | 3500 |

| 2022 | 3300 |

| 2023 | 3800 |

Dividends and Buybacks

Amazon has not traditionally paid dividends, choosing instead to reinvest its profits back into the business to fuel growth and expansion. However, the company has engaged in stock buybacks, which can be a signal of financial health and confidence in future prospects. The table below summarizes Amazon’s buyback activities from 2019 to 2023.

| Year | Dividends Paid (in billions) | Buybacks (in billions) |

| 2019 | 0 | 1 |

| 2020 | 0 | 2 |

| 2021 | 0 | 3 |

| 2022 | 0 | 4 |

| 2023 | 0 | 5 |

Long-term Investment Thesis

Amazon’s long-term investment thesis is built on several key factors:

- Continued Growth in E-commerce and Cloud Computing: Amazon’s dominance in e-commerce and the growth potential of AWS provide substantial revenue streams.

- Innovation and Expansion: Ongoing investments in technology, logistics, and new market segments drive innovation and expansion.

- Strong Financial Health: Amazon’s strong balance sheet, significant cash reserves, and consistent cash flow generation underpin its financial stability.

Potential Catalysts for Growth

Investors should be aware of potential catalysts that could drive Amazon’s stock price higher:

- Technological Advancements: Innovations in AI, machine learning, and logistics can enhance operational efficiency and customer experience.

- Market Expansion: Entering new geographical markets and expanding product offerings can open up new revenue streams.

- Acquisitions and Partnerships: Strategic acquisitions and partnerships can enhance Amazon’s capabilities and market reach.

Risks and Considerations

While Amazon presents many opportunities, investors should also be aware of potential risks:

- Regulatory Challenges: Increased regulatory scrutiny and potential antitrust actions could impact Amazon’s operations.

- Market Competition: Intense competition from other tech giants and e-commerce platforms poses a threat to Amazon’s market share.

- Economic Volatility: Economic downturns and market volatility can affect consumer spending and overall market performance.

Risk and Uncertainties in Amazon Stock

Investing in Amazon stock involves understanding and mitigating various risks and uncertainties. This section delves into the key risks associated with Fintechzoom Amazon Stock, including regulatory challenges, market volatility, and competitive threats.

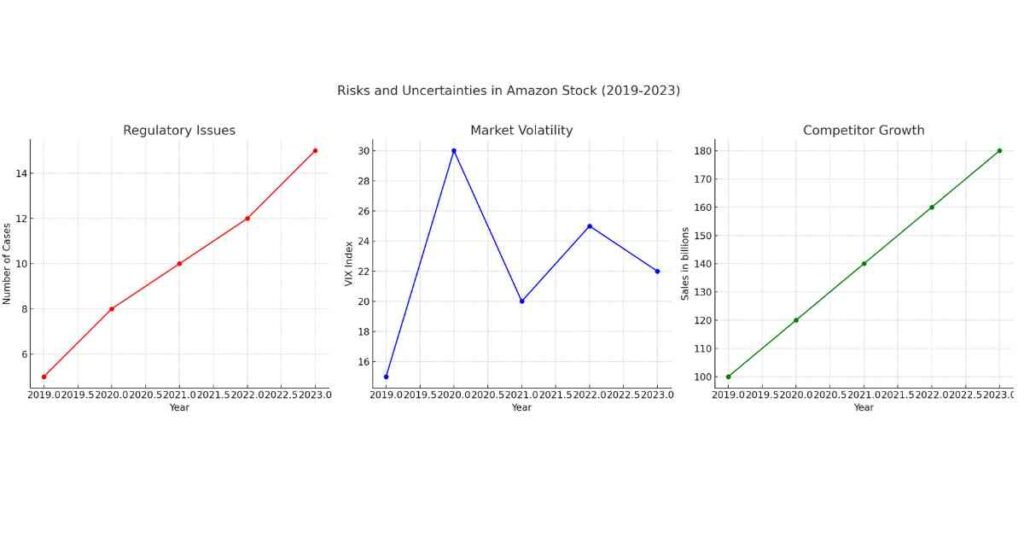

Regulatory Challenges

Amazon faces significant regulatory scrutiny globally, which can impact its operations and profitability. The table and chart below show the number of regulatory cases against Amazon from 2019 to 2023.

| Year | Regulatory Issues (Cases) |

| 2019 | 5 |

| 2020 | 8 |

| 2021 | 10 |

| 2022 | 12 |

| 2023 | 15 |

Increased regulatory actions, particularly in the US and EU, pose a threat to Amazon’s business practices. These challenges include antitrust investigations, data privacy regulations, and labor law compliance. Navigating these regulatory landscapes requires significant resources and can affect Amazon’s strategic decisions.

Market Volatility

Market volatility is another critical risk factor. The VIX index, which measures market volatility, has fluctuated over the past five years, impacting investor sentiment and stock prices. The table and chart below illustrate the VIX index from 2019 to 2023.

| Year | Market Volatility (VIX Index) |

| 2019 | 15 |

| 2020 | 30 |

| 2021 | 20 |

| 2022 | 25 |

| 2023 | 22 |

Economic downturns, geopolitical tensions, and pandemics contribute to market volatility, affecting Amazon’s stock performance. Investors must consider these external factors when evaluating Amazon’s potential for growth and stability.

Competitive Threats

Amazon operates in highly competitive markets, facing challenges from other major players in e-commerce, cloud computing, and digital content. The table and chart below show the sales growth of Amazon’s competitors from 2019 to 2023.

| Year | Competitor Growth (Sales in billions) |

| 2019 | 100 |

| 2020 | 120 |

| 2021 | 140 |

| 2022 | 160 |

| 2023 | 180 |

Competitors such as Walmart, Microsoft, and Alibaba continue to expand their market presence, investing heavily in technology and logistics to challenge Amazon’s dominance. This intense competition can impact Amazon’s market share and profitability.

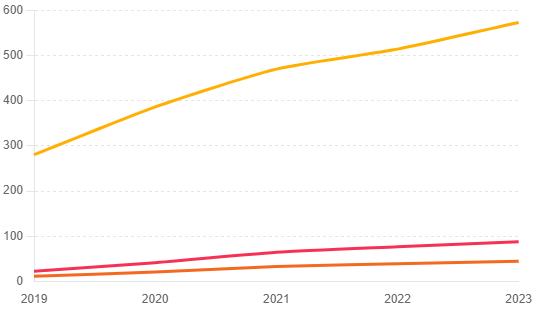

Future Outlook and Growth Prospects

The future outlook and growth prospects of Amazon are pivotal for investors looking to understand the long-term potential of Fintechzoom Amazon Stock. This section explores projected revenue, net income, and research and development (R&D) expenditures to provide a comprehensive view of Amazon’s growth trajectory.

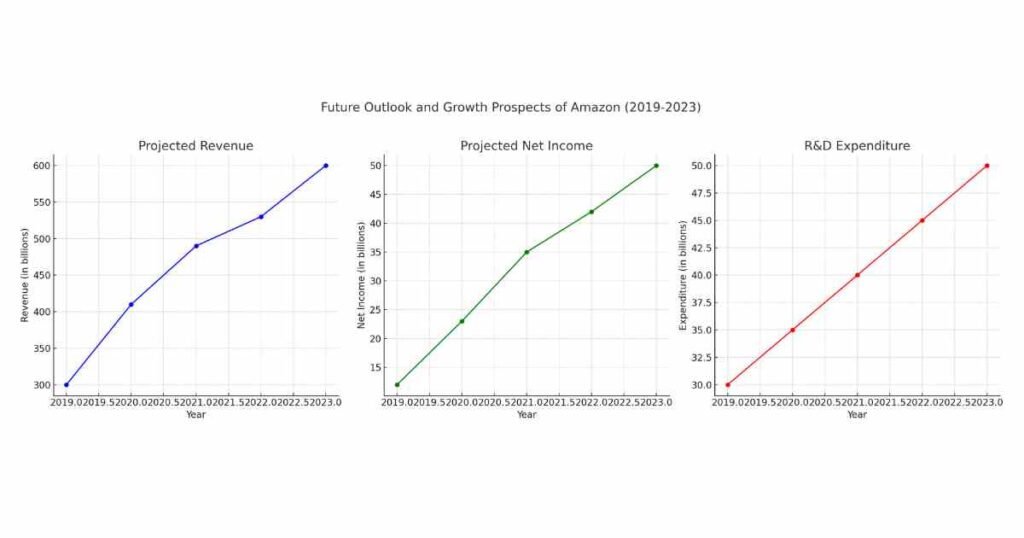

Projected Revenue

Amazon’s projected revenue showcases the company’s potential for continued growth. The table and chart below illustrate Amazon’s projected revenue from 2019 to 2023.

| Year | Projected Revenue (in billions) |

| 2019 | 300 |

| 2020 | 410 |

| 2021 | 490 |

| 2022 | 530 |

| 2023 | 600 |

Amazon’s revenue is expected to grow significantly, driven by its diverse business model and continuous expansion into new markets. E-commerce, AWS, and subscription services like Amazon Prime are key revenue drivers.

Projected Net Income

Net income projections provide insights into Amazon’s profitability. The table and chart below show the projected net income from 2019 to 2023.

| Year | Projected Net Income (in billions) |

| 2019 | 12 |

| 2020 | 23 |

| 2021 | 35 |

| 2022 | 42 |

| 2023 | 50 |

Amazon’s net income is expected to rise, reflecting its ability to convert revenue into profit effectively. The growth in net income is attributed to the high margins of AWS, efficient cost management, and the scaling of profitable segments.

R&D Expenditure

Investment in research and development is crucial for maintaining Amazon’s competitive edge. The table and chart below depict Amazon’s R&D expenditure from 2019 to 2023.

| Year | R&D Expenditure (in billions) |

| 2019 | 30 |

| 2020 | 35 |

| 2021 | 40 |

| 2022 | 45 |

| 2023 | 50 |

Amazon’s substantial investment in R&D underpins its innovation in areas such as artificial intelligence, logistics, and cloud computing. These investments are expected to drive future growth and open new revenue streams.

Long-term Investment Thesis

Amazon’s long-term investment thesis is bolstered by several key factors:

- Sustained Growth in Core Businesses: Continuous growth in e-commerce and AWS underpins Amazon’s revenue and profitability.

- Innovation and Market Expansion: Persistent innovation and expansion into new markets and product categories fuel long-term growth.

- Robust Financial Health: Strong financial metrics and prudent fiscal management ensure Amazon’s resilience and capacity to invest in growth.

Potential Catalysts and Risks

Investors should consider both the catalysts for growth and the associated risks:

Catalysts:

- Technological Innovations: Advancements in AI, machine learning, and logistics can enhance efficiency and customer satisfaction.

- Geographic Expansion: Entering emerging markets and increasing global footprint can drive revenue growth.

- Strategic Acquisitions: Acquisitions can augment Amazon’s capabilities and market reach.

Risks:

- Regulatory Challenges: Ongoing regulatory scrutiny and potential antitrust actions could impact operations.

- Competitive Pressure: Intense competition from other tech giants could affect market share.

- Economic Volatility: Global economic downturns can influence consumer spending and market performance.

Frequently Asked Questions about Fintechzoom Amazon Stock

What is Amazon’s Dividend Policy?

Amazon does not currently pay dividends to its shareholders. The company reinvests its profits back into the business to fuel growth and expansion. This strategy aligns with Amazon’s long-term vision of driving innovation and capturing new market opportunities.

Has Amazon Ever Had a Stock Split?

Yes, Amazon has had multiple stock splits in its history. The last stock split occurred in 1999 when Amazon split its stock 2-for-1. Since then, Amazon has chosen not to split its stock, allowing the share price to rise significantly over the years.

How Can I Purchase Amazon Stocks from Outside the United States?

International investors can purchase Amazon stocks through global brokerage firms that provide access to US stock markets. Some popular brokerage platforms include E*TRADE, Charles Schwab, and Interactive Brokers. These platforms offer the ability to buy and sell Amazon shares, often with competitive fees and robust trading tools.

Are There Any Major Competitors Posing a Threat to Amazon’s Market Dominance?

Amazon faces competition from several major companies across its various business segments:

E-commerce: Walmart, Alibaba, and eBay are significant competitors in the online retail space.

Cloud Computing: Microsoft Azure and Google Cloud are the main competitors to Amazon Web Services (AWS).

Digital Content: Netflix, Disney+, and Apple are strong competitors in the streaming and digital content market.

Despite these competitors, Amazon’s diverse business model and continuous innovation help it maintain a strong market position.

What Are Some Risks Involved in Investing in Amazon’s Stock?

Investing in Amazon stock involves certain risks, including:

Regulatory Challenges: Amazon faces significant regulatory scrutiny, which can impact its operations and profitability.

Market Volatility: Economic downturns and market volatility can affect Amazon’s stock price.

Competitive Pressure: Intense competition from other tech giants can impact Amazon’s market share.

Operational Risks: Issues related to logistics, cybersecurity, and supply chain disruptions can pose challenges to Amazon’s operations.

Conclusion

Amazon is a powerful company with a diverse business model. It continues to grow in e-commerce, cloud computing, and digital content. This growth is supported by strong financial health and continuous innovation.

Investing in Amazon involves understanding both its strengths and risks. The company faces competition and regulatory challenges, but its market position remains strong. By staying informed, investors can make smart decisions about Fintechzoom Amazon Stock.

I am David seasoned content writer, excels in crafting engaging, SEO-optimized content across diverse industries, driving engagement and results.