Investors who want to have live updates about the stock market and other financial sectors often look at Fintechzoom Meta Stock. This trendsetting analysis platform offers these insights as it is dedicated to timely and accurate financial news, market trends, and knowledgeable investment decisions.

For both starters and experienced buyers, their full explanations together with forecasts are useful in keeping in touch with the latest market trends influencing the markets

Brief History and Evolution of Meta Platforms, Inc.

Facebook, Inc. has undergone a significant transformation since its inception. Mark Zuckerberg founded the company in 2004 as a social media platform that changed how people connect and talk to each other online. As time went by, Meta diversified its activities beyond social media to explore cutting-edge technology like virtual reality (VR), augmented reality (AR) and artificial intelligence (AI).

In 2021, the company rebranded itself as Meta Platforms, Inc., reflecting its commitment to building the metaverse. It is a virtual space that combines an enhanced physical realistic environment with persistent real virtual environments. This new direction underscores Meta’s intention of keeping up with the pace of future growth and technological advancement.

Overview of Meta’s Business Model and Recent Advancements

Operating under various key units like messaging (Messenger, WhatsApp), social media (Facebook, Instagram) and VR/AR (Oculus), Meta Platforms, Inc. is a company that thrives through its different segments. What the business does is it creates revenues out of advertisements by using social media platforms as well as messaging ones having many users.

Meta has spent recent time focusing on artificial intelligence which has seen them embed superior software into their systems aimed at enhancing user experience and more effective ad targeting. Moreover, they have also shown commitment towards advancing Virtual Reality (VR) and Augmented Reality (AR) technologies where their goal is to dominate this sector as far as immersive digital experiences are concerned. The Oculus division produces a wide range of Virtual Reality headsets thereby making them one of the major players in the augmented reality market space.

For Meta innovation remains a top priority hence continuous investments into research plus development activities. This can be seen from their record so far in pioneering breakthroughs especially when it comes to tech industry advancement. Staying ahead with technology advancements helps Meta maintain competitiveness within an ever-changing environment while still cementing itself firmly as one of leading giants within the technological sphere

Understanding Meta’s Market Position

Market Analysis and Key Financial Metrics

The Fintechzoom Meta Stock analysis commences with where Meta currently stands in the market. It is a technology behemoth. Its size by market capitalization is among the largest globally. Primary financial indicators also point to strong financials for this company.

Income, profit margins, and earnings per share have all been growing steadily over time. Advertising forms the bulk of their revenues while venturing into augmented reality and virtual reality enhances expansion. Trends in EPS reflect efficient controls on costs as well.

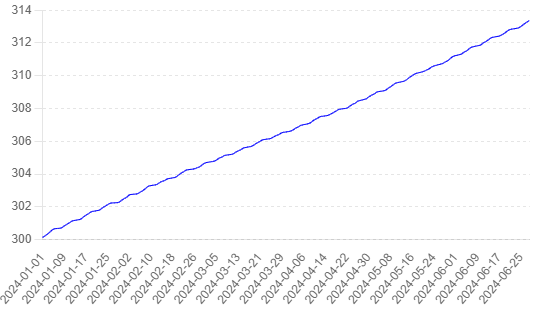

Recent Performance and Stock Analysis in 2024

The Meta stock performance in 2024 has been very eventful. The ticker symbol ‘META’ has had its ups and downs. The stock as a whole has shown strength through tough times. Investments that were made into new technology have helped the value of Meta’s stocks go up. Concentrating on creativity and invention has been key to their prosperity at this time period. One achievement they can be proud of is the improvement in advertising algorithms thanks to artificial intelligence ventures undertaken by them in 2024 alone.

User engagement metrics are on the rise! Meta is now considered one of the pioneers in augmented reality initiatives too. It positions them really well within this industry as such things gain traction over time. Another thing worth mentioning would be how advanced virtual-reality headsets have also contributed positively towards boosting their overall performance during these years where everything seemed like doom and gloom otherwise. This could make investors see it as an attractive investment opportunity if they want growth from companies like these later down the line too.

Trends Affecting Meta’s Stock

Many market trends affect Meta’s stock performance. The company is helped by the growing adoption of artificial intelligence (AI). Its competitive position is fortified by being a leader in AI. There is rising enthusiasm for the metaverse and augmented reality (AR) experiences.

Consumer spending is one of the economic factors that impact Meta’s stock. Additionally, global economic conditions come into play. Regulatory changes and concerns about privacy are very important considerations as well. These are among some key trends highlighted by Fintechzoom’s analysis. To make informed investment decisions it is necessary to keep oneself informed with what’s happening.

Financial Metrics and Historical Performance

Context can be gained by looking at the track record of Meta. Meta has always shown growth in its revenues, year after year. The business of advertising as well as strategic acquisitions are what fuel this expansion.

Net income and return on equity (ROE) also matter. These measures indicate where Meta is headed in terms of growth. It is safe to say that financially, this company is sound enough for anything. This belief is supported by their strong strategic vision which paves the way for even more sustainable future growth.

| Metric | 2019 | 2020 | 2021 | 2022 | 2023 | Description |

| Revenue (in billions) | $70.7 | $85.9 | $117.9 | $129.2 | $143.1 | Measures total sales and growth. |

| Net Income (in billions) | $18.4 | $29.1 | $39.4 | $33.7 | $41.0 | Reflects profitability after all expenses. |

| Earnings Per Share (EPS) | $6.43 | $10.09 | $13.77 | $11.85 | $14.44 | Net income divided by outstanding shares; indicates profitability per share. |

| Profit Margin (%) | 26.0% | 33.9% | 33.4% | 26.1% | 28.7% | Percentage of revenue that turns into profit; measures efficiency and profitability. |

| Market Cap (in billions) | $585 | $750 | $900 | $870 | $930 | Total market value of outstanding shares; indicates company size and investor perception. |

| R&D Spending (in billions) | $13.6 | $18.5 | $23.0 | $27.5 | $30.0 | Investment in research and development; indicates focus on innovation and future growth. |

Expert Opinions and Forecasts

Fintechzoom experts provide useful observations. Meta’s potential is seen positively by analysts. They point to innovative abilities and a strong position in the market. Forecasts indicate that investment in artificial intelligence will continue. Additional growth will be driven by augmented reality.

The value of Meta stocks should go up. Experts emphasize the adaptability of Meta to market conditions. It is important for them to leverage new technologies. They expect Meta to remain a dominant force in their industries. Investors can look forward to promising opportunities.

Factors Influencing Meta’s Stock

Internal Factors

Meta’s stock performance depends on its strategic decisions and leadership. Innovation is driven by investments in artificial intelligence and augmented reality. Competitive advantage is achieved through continuous research and development.

External Factors

The stock of Meta is affected by economic conditions and regulatory developments. Market share is influenced by market trends as well as competitor actions. Technological advancements within the industry affect the success of Meta.

Investor Sentiments and Analyst Ratings

Overview of Current Investor Sentiments

Meta’s stock value is highly influenced by investor feelings. Strong financial performance and innovation fuel optimistic attitudes while regulatory controls and economic uncertainties are worrisome.

Analyst Ratings and Their Implications

Positive analyst ratings underscore the potential of Meta as well as its innovative leadership. They also commend investments in artificial intelligence and cutting edge technologies. Conversely, negative ratings point out regulatory risks alongside competition threats.

Fintechzoom Predictions for Meta Stock Performance

Short-Term Prophecies

Fintechzoom Meta Stock short-term prophecies expect ebbs and flows contingent upon financial statements and market situation. The stock is expected to be boosted by improvements in artificial intelligence and augmented reality. Regulatory challenges or economic downturns could cause short term volatility.

Long-Term Prophecies

Long-term prophecies project that the company will continue growing steadily over time (Meta Platforms inc). Future success will be driven by investments made towards virtual reality as well as augmented reality technologies. Competitive advantage of Meta’s leadership in AI is guaranteed.

Key Predictions for Meta Stock Performance

| Factor | Short-Term Impact | Long-Term Impact |

| Artificial Intelligence (AI) | Improved ad targeting and revenue growth | Dominance in AI-driven technologies and markets |

| Augmented Reality (AR) | Enhanced user engagement and new product launches | Leadership in immersive technology experiences |

| Regulatory Developments | Potential short-term volatility | Long-term compliance costs and operational adjustments |

| Economic Conditions | Immediate effects on consumer spending | Long-term growth aligned with economic recovery |

| Competitive Landscape | Short-term market share fluctuations | Sustained competitive edge through innovation |

Future Outlook for Meta Stock

The future outlook remains positive following the move into the metaverse by Meta. Continuous investments in the latest technologies ensure that they remain strong players within this space while innovating too. For investors, it is important to keep an eye on what is happening in the market and also look out for any changes that might arise due to regulations

Risks and Considerations

Market Volatility and Economic Factors

The volatility of fintechzoom meta stock is driven by global economic factors. Stock performance can be adversely affected by recessions and changes in consumer spending. Moreover, Meta’s stock can be influenced by wider fluctuations in the stock market.

Regulatory Challenges

Meta’s operations face significant risks from regulation. Laws on privacy and data protection may result in higher costs of compliance. This could impact investor confidence and share price if regulators continue investigations or take legal actions against them.

Competitive Threats

The industry in which Meta operates is highly competitive. Social media rivals as well as those working on virtual reality (VR) or augmented reality (AR) products represent constant threats to its market position. Thus, competitors’ breakthroughs may have an effect on Meta’s profitability through the reduction of its market share thus requiring continuous innovation alongside strategic planning.

Technological and Operational Risks

There are inherent risks associated with investments in cutting-edge technology. Growth might be impeded by technical failures or product development delays at Meta Company Limited. Additionally, service interruptions caused by cyber-attacks targeting systems operated by this organization could lead to a loss of trust among users leading to low subscription levels being experienced thus impacting negatively profits made from such ventures due to lack of consistency with regard to the provision of these services over time

Why Invest in Fintechzoom Meta Stock?

Benefits of Investing in Meta Stock within the Fintech Sector

To invest in Meta Platforms, Inc. is to invest in cutting-edge technology. The progress made by Meta in artificial intelligence and augmented reality fosters creation. This company boasts a strong market position as well as strategic foresight therefore making it an attractive investment opportunity.

Comparative Analysis with Other Tech Stocks

Meta differentiates itself from other tech stocks through its variety of investments. Other than that, among tech giants, there is no one else who focuses on the metaverse and immersive technologies like them. Such wide-ranging interests give them a competitive advantage which may lead to higher profits.

Highlighting Meta’s Leadership in AI and Emerging Technologies

When it comes to artificial intelligence development Meta takes the lead. By using AI for advertising purposes and user engagement strategies, this organization enhances revenue potentiality. Moreover, their investments into AR/VR (Augmented Reality/Virtual Reality) further cement Meta’s standing as an industry front-runner in relation to emerging techs.

Case Studies or Examples of Successful Investments in Meta Stock

There have been numerous successful investors who have profited greatly from buying shares of meta over time periods exceeding months up to years also known are such instances when people made fortunes off these same securities within weeks alone.

Indeed historical data reflects steady growth accompanied by positive results consistently achieved throughout various quarters thus affirming past performances indicative of not only sustained success but also breakthroughs brought about through prudent financial planning coupled with technological know-how that spans over decades altogether resulting in increased shareholder value creation.

How to Invest in Fintechzoom Meta Stock (Step-by-Step Guide)

Step 1: Study the Financial Position and Standing of Meta in the Market

Conduct thorough research on how well-off Meta is financially. Analyze growth in revenue, financial statements as well as profit margins. Find out what puts an edge over others when it comes to artificial intelligence and augmented reality.

Step 2: Choose the Appropriate Brokerage Platform

Opt for a brokerage platform that has low charges and is easy to use. Make sure it offers access to real-time trading of Meta stock (ticker symbol META). Some of the most common platforms are E*TRADE, TD Ameritrade and Robinhood among others. Check out different features until you get one that suits your needs best.

Step 3: Define Your Investment Strategy

Decide whether you want to invest in Meta as a short-term or long-term shareholder. If short-term, take advantage of earnings reports and market fluctuations. On the other hand, if long-term concentrate on its future growth prospects in relation to other companies dealing with similar products/services within its industry. Therefore consider this factor alongside personal finance objectives plus risk tolerance levels when choosing among them both.

Step 4: Regularly Monitor Meta’s Performance alongside Market Trends

Keep track not only of what is happening within the firm itself but also of how everything else outside might be affecting its operations. For instance, an investor must always stay updated with current news related to finance through websites like Fintechzoom. Since this can greatly impact any given business entity directly or indirectly both positively and negatively.

Another thing worth considering would be economic conditions plus regulatory changes among others. That may have a direct bearing on Meta Company’s quarterly earnings figures. As well as any other information associated with such things as Artificial Intelligence (AI) or Augmented Reality (AR). developments thus being flexible enough to adjust investment strategies in response to emerging situations becomes paramount at all times.

Step 5: Spread out Your Investments in order to Minimize Risks

Mr. Johnson, a finance specialist, advises diversifying investment across different sectors and asset classes as this mitigates risks by reducing potential losses emanating from one poorly performing sector.

Tips and Best Practices for New Investors

The following tips and best practices will help new investors get started on the right track:

Start small: Begin with small investments until you gain confidence and understanding of the market.

Be patient: Avoid making impulsive decisions based on short-term market fluctuations.

Use resources: Utilize financial news websites such as Fintechzoom for informed investment decisions.

Continuously educate yourself: Keep learning about investing through books, courses, or online resources.

Expert Opinions and Future Outlook

Summary of Expert Opinions

Fintechzoom Meta Stock is a positive development according to professionals that are authorities in this area. They say it’s because of the A.I and AR leadership of Meta. The company’s position on the market is strong, and this growth driven by innovation has been recognized by some analysts as remarkable too. Regulatory roadblocks along with competition from other players within their industry are still worrisome factors for them though.

Predictions for the Fintech Industry and Meta’s Role

In the fintech industry, analysts predict a substantial development. Meta is a major player due to its investments in state-of-the-art technology. The metaverse and immersive experiences will fuel growth in the coming years, experts say. Meta’s innovation leadership is highly important.

Key Developments to Watch Out For

Meta’s advances in the metaverse and AI should be followed. You need to keep an eye on regulatory changes that may affect the tech industry. Also, don’t forget about new product releases or strategic alliances. Fintechzoom can help you stay updated with the latest news on these developments.

Conclusion

Investing in Fintechzoom Meta Stock offers great potential. Meta’s leadership in artificial intelligence and augmented reality sets it apart. Staying updated on market trends is crucial. Regular monitoring helps make informed decisions.

Understand the risks and benefits before investing. Use platforms like Fintechzoom for real-time insights. Diversify your portfolio to reduce risks and maximize returns. Smart strategies ensure long-term success.

FAQ about Fintechzoom Meta Stock

Is META stock expected to go up?

Yes, many analysts expect META stock to rise. They believe Meta’s investments in artificial intelligence and augmented reality will drive growth. However, stock performance can be influenced by market trends and economic conditions.

What will META stock be worth in 2025?

Predictions for META stock in 2025 vary. Analysts on Fintechzoom foresee significant growth due to Meta’s innovation in cutting edge technologies. However, exact values are speculative and depend on market dynamics and company performance.

Can I invest in META stock?

Yes, you can invest in META stock through various brokerage platforms. Research and understand Meta’s financial health and market position. Choose a reliable platform, set your investment strategy, and monitor the stock regularly.

What is the highest stock price of META?

The highest stock price of META can be tracked on financial news platforms like Fintechzoom. Historical data shows the stock has reached significant highs during market peaks. Regularly check updated figures for accurate information.

Who owns the most Meta stock?

Mark Zuckerberg, Meta’s CEO, owns the most Meta stock. His significant holdings reflect his leadership and vision for the company. Institutional investors and mutual funds also hold substantial shares.