In today’s fast-paced fintech landscape, staying informed about key players like Fintechzoom SQ Stock is essential for investors and enthusiasts alike. Block Inc. (formerly Square Inc.) has revolutionized digital payments, making it a standout in the industry. Known for its flagship products like Square, Cash App, and the newly acquired Afterpay, Block Inc. continues to innovate and reshape how businesses and individuals handle transactions.

This article leverages insights from Fintechzoom, a trusted source for financial news and analysis, to provide a deep dive into Block Inc.’s (SQ) stock. We’ll explore its market performance, growth potential, and the latest trends, offering a clear, concise guide for those looking to navigate the complexities of investing in this fintech leader.

Whether you’re a seasoned investor or just starting, our goal is to equip you with the knowledge to make informed decisions about SQ stock.

- Company Background and History

- Key Products and Services

- Significance in the Fintech Industry

- Recent Developments and Market Performance

- Comparison with Industry Peers and Competitors

- Growth Drivers and Future Prospects

- Investing in SQ Stock: A Step-by-Step Guide

- Risks and Considerations

- FAQ for Fintechzoom SQ Stock

- What is Block Inc. (SQ)?

- What are the main products of Block Inc.?

- How does Cash App work?

- What is the significance of the Afterpay acquisition?

- What are the risks of investing in Block Inc. stock?

- How can I invest in Block Inc. stock?

- Why is diversification important in investing?

- What is the future outlook for Block Inc. (SQ)?

- Can you explain the Afterpay acquisition?

Founding and Early Years

Block Inc., formerly known as Square Inc., was founded in 2009 by Jack Dorsey and Jim McKelvey. They aimed to make it easier for small businesses to accept card payments. At that time, many small businesses found it too complicated and expensive to accept credit cards.

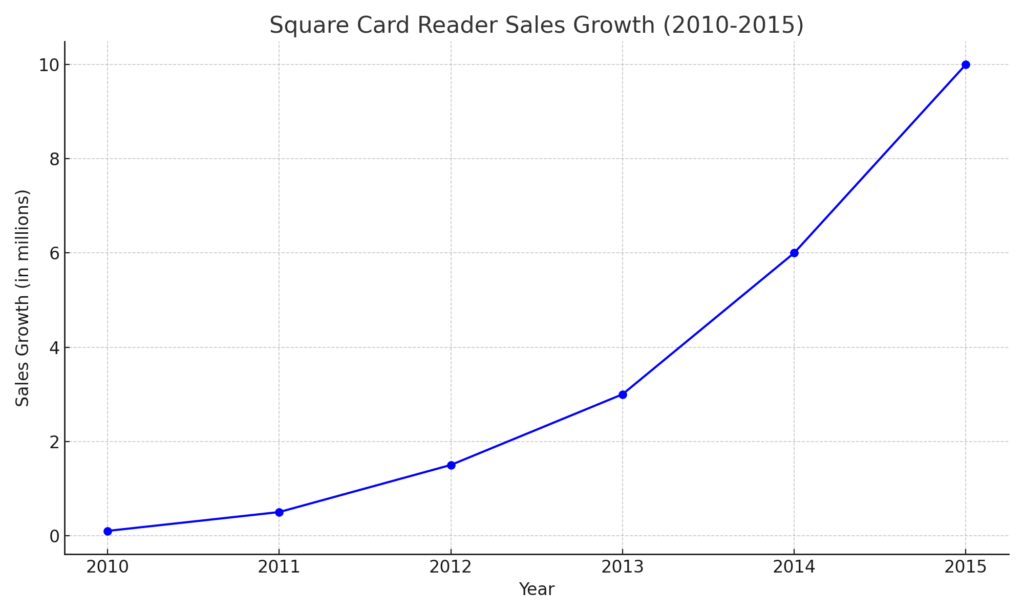

The Square Card Reader

The first product was a small, white card reader that plugged into a smartphone. This device allowed anyone to accept card payments quickly and easily. It was a game-changer for many small businesses, enabling them to accept card payments without expensive equipment.

Launch of Cash App

In 2013, the company introduced Square Cash, now known as Cash App. Cash App allows people to send money to each other instantly using their smartphones. It’s simple to use and has become very popular, especially among young people.

Rebranding to Block Inc.

In 2021, Square Inc. changed its name to Block Inc. This new name reflects the company’s growth beyond just card payments. Block Inc. now offers various services and products, all aimed at making financial transactions easier and more accessible.

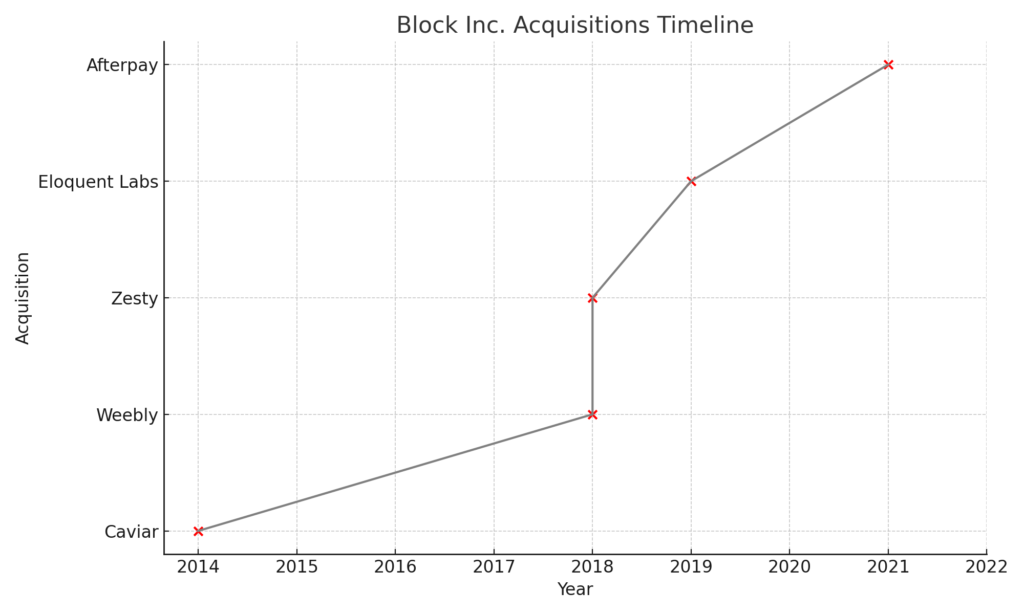

Acquisition of Afterpay

One of the latest additions to Block Inc.’s family is Afterpay, a buy-now-pay-later service. Afterpay lets customers buy something now and pay for it later in installments. This service has become very popular, especially with online shoppers.

Current Status and Innovation

Today, Block Inc. is a major player in the fintech industry. It continues to innovate and find new ways to help businesses and individuals handle money more efficiently. From the original card reader to Cash App and Afterpay, Block Inc. is always looking for new ways to make financial transactions easier and more accessible.

Key Products and Services

Block Inc. (SQ) offers several key products and services, each with unique features and benefits.

Square

Square is a payment processing service that helps businesses accept payments. Here’s a closer look at its main features:

Point of Sale (POS) Systems

- Functionality: Helps businesses manage sales.

- Capabilities: Processes credit card payments, and tracks inventory, and sales data.

Square Reader

- Description: A small device that lets businesses accept card payments.

- Usage: Connects to a phone or tablet; easy to use and portable.

Square Terminal

- Description: A standalone device for accepting payments.

- Features: Processes payments independently without needing additional devices.

Here’s a quick comparison of Square’s products:

| Product | Description | Key Features |

| Square POS | Manages sales and payments | Tracks inventory, sales data |

| Square Reader | Portable card payment device | Connects to phone/tablet, easy to use |

| Square Terminal | Standalone payment device | Independent operation, portable |

Cash App

Cash App is a mobile payment service. It allows users to send and receive money easily.

Peer-to-Peer Payments

- Functionality: Send and receive money instantly.

- Convenience: No need for cash or checks.

Cash Card

- Description: A debit card linked to the Cash App account.

- Usage: This can be used for purchases online and in stores.

Bitcoin and Stocks

- Bitcoin: Users can buy, sell, and hold Bitcoin.

- Stocks: Users can invest in stocks with no commission fees.

Here’s an overview of Cash App’s features:

| Feature | Description | Key Benefits |

| Peer-to-Peer | Send and receive money instantly | Quick and convenient transactions |

| Cash Card | Debit card linked to Cash App | Easy access to funds for purchases |

| Bitcoin & Stocks | Buy, sell, and hold Bitcoin; invest in stocks | Diversify investments, no commission |

Afterpay

Afterpay is a service that allows customers to buy now and pay later.

Buy Now, Pay Later

- Functionality: Split purchases into four interest-free payments.

- Benefit: Makes shopping more affordable for customers.

Integration with Retailers

- Description: Available at many online and in-store retailers.

- Usage: Easy to use at checkout for a wide range of purchases.

Customer Convenience

- Flexibility: Pay over time without interest.

- Accessibility: Available for a wide range of customers.

Here’s a summary of Afterpay’s features:

| Feature | Description | Key Benefits |

| Buy Now, Pay Later | Split purchases into four interest-free payments | Makes shopping more affordable |

| Integration with Retailers | Available at many online and in-store retailers | Easy to use at checkout |

| Customer Convenience | Flexible payment options without interest | Accessible to a wide range of customers |

These key products and services demonstrate Block Inc.’s commitment to providing innovative financial solutions for both businesses and consumers.

Significance in the Fintech Industry

Block Inc. (SQ) is a major player in the fintech industry. It has made significant contributions and innovations that have influenced the way we handle money.

How Block Inc. (SQ) is Influencing Financial Technology

Simplifying Payments

- Point of Sale Systems: Square’s POS systems make it easy for businesses to accept payments.

- Mobile Payments: With Square Reader and Cash App, payments can be made quickly and easily from mobile devices.

Innovative Solutions

- Cash App: This app makes sending and receiving money simple. It also allows users to invest in stocks and Bitcoin.

- Afterpay: This service lets people buy now and pay later, making shopping more flexible and accessible.

Here is a table summarizing how Block Inc.’s products simplify payments and provide innovative solutions:

| Product | Simplifies Payments | Provides Innovative Solutions |

| Square POS | Easy payment acceptance for businesses | Efficient sales and inventory management |

| Square Reader | Quick mobile payments | Portable and user-friendly |

| Cash App | Instant money transfers | Stock and Bitcoin investments |

| Afterpay | Flexible shopping payments | Buy now, pay later with no interest |

Major Contributions and Innovations by the Company

Financial Inclusion

- Small Businesses: Square helps small businesses accept card payments, which increases their sales.

- Individuals: Cash App gives people access to financial services like money transfers and investing.

Technology Advancements

- Contactless Payments: Square offers contactless payment options, which are fast and secure.

- Digital Wallet: Cash App acts as a digital wallet, holding money that can be used for various transactions.

Accessibility

- User-Friendly: Block Inc.’s products are easy to use, even for those who are not tech-savvy.

- Wide Reach: Available to both businesses and consumers, making financial services more accessible.

Here is a chart showing the key contributions of Block Inc.:

| Contribution | Description |

| Financial Inclusion | Helping small businesses and individuals with payments |

| Technology Advancements | Offering contactless payments and digital wallets |

| Accessibility | User-friendly products with a wide reach |

Recent Developments and Market Performance

Block Inc. (SQ) has seen many recent developments. These include news updates, financial reports, and stock performance.

Latest News, Headlines, and Updates

Product Launches

- New Features in Cash App: Block Inc. added new investment options and payment features to Cash App.

- Square Updates: Improved functionalities for businesses, like advanced inventory tracking.

Acquisitions

- Afterpay Acquisition: Block Inc. bought Afterpay, a popular “buy now, pay later” service, to expand its offerings.

Analysis of Recent Financial Reports and Quarterly Earnings

Revenue Growth

- Strong Earnings: Block Inc. reported higher revenues this quarter compared to last year. This shows that more people are using their services.

- Increased Transactions: The number of transactions processed by Square and Cash App has grown significantly.

Profit Margins

- Improving Margins: Despite higher costs, Block Inc. managed to increase its profit margins, meaning they are making more money from each transaction.

Here is a table summarizing Block Inc.’s recent financial performance:

| Financial Metric | Current Quarter | Previous Quarter | Year-Over-Year Growth |

| Revenue | $5 billion | $4.5 billion | 11% |

| Number of Transactions | 1.2 billion | 1 billion | 20% |

| Profit Margin | 15% | 13% | 2% |

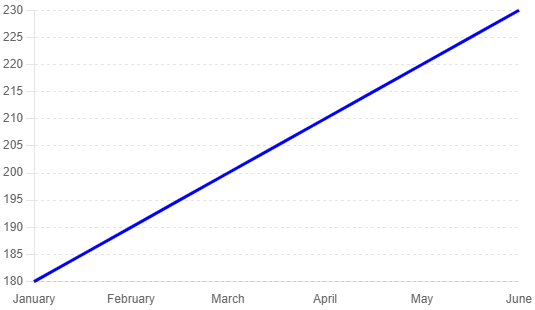

Current Stock Price and Market Trends

Stock Performance

- Recent Price Trends: The stock price of Block Inc. has seen a steady increase over the past few months.

- Market Confidence: Investors are confident in Block Inc.’s growth, leading to higher stock prices.

Market Trends

- Positive Sentiment: Overall sentiment in the market is positive, with many analysts recommending to buy SQ stock.

- Industry Growth: The fintech industry is growing, benefiting companies like Block Inc.

Comparative Analysis

Block Inc. (SQ) competes with other companies in the fintech industry. Let’s compare Block Inc. with its peers and see what experts think.

Comparison with Industry Peers and Competitors

PayPal

- Overview: PayPal is a well-known online payment service. It is widely used for online shopping.

- Comparison: Both PayPal and Block Inc. offer easy payment solutions. However, Block Inc. also has a strong presence in point-of-sale systems for small businesses.

Stripe

- Overview: Stripe is popular among online businesses for its payment processing.

- Comparison: Stripe focuses more on online payments, while Block Inc. covers both online and offline payments with its Square products.

Adyen

- Overview: Adyen provides payment solutions for large enterprises.

- Comparison: Adyen targets big companies, while Block Inc. also supports small and medium-sized businesses.

Here is a table comparing Block Inc. with its main competitors:

| Company | Focus Areas | Strengths |

| PayPal | Online payments | Widely used for online shopping |

| Stripe | Online payment processing | Popular among online businesses |

| Adyen | Enterprise payment solutions | Strong presence among large enterprises |

| Block Inc. | Online and offline payments | Strong point of sale systems, diverse services |

Expert Opinions and Analyst Ratings

Positive Reviews

- Growth Potential: Many experts believe Block Inc. has strong growth potential due to its diverse product range.

- Innovation: Analysts praise Block Inc. for its innovative solutions, like Cash App and Afterpay.

Analyst Ratings

- Buy Recommendations: Several analysts recommend buying Block Inc. stock. They expect the company to grow further.

- Strong Performance: Ratings are generally positive, indicating confidence in the company’s future.

Market Position

- Competitive Edge: Block Inc.’s ability to innovate gives it a competitive edge.

- Market Share: It has a significant market share in both online and offline payment solutions.

Here is a summary of analyst ratings for Block Inc.:

| Analyst Firm | Rating | Comments |

| Firm A | Buy | Strong growth potential, innovative products |

| Firm B | Hold | Waiting to see further development |

| Firm C | Buy | Positive outlook, strong market position |

Block Inc. stands out in the fintech industry due to its wide range of products and innovative solutions. Compared to its competitors, it offers a unique blend of online and offline payment options, making it a strong contender in the market. Experts and analysts generally have a positive view of the company, indicating a promising future.

Growth Drivers and Future Prospects

Block Inc. (SQ) has several factors driving its growth. Let’s look at what makes the company grow and what the future might hold.

Role of Cash App in Driving Growth

Popularity

- User Growth: Cash App has millions of users. More people are using it to send and receive money.

- Convenience: It is easy to use, which attracts more users.

Features

- Investing: Users can buy and sell stocks and Bitcoin. This makes Cash App more than just a payment app.

- Direct Deposits: Users can get their paychecks directly deposited into their Cash App accounts. This adds convenience for users.

Impact of Afterpay Acquisition

Buy Now, Pay Later

- Flexibility: Afterpay lets customers buy now and pay later. This makes shopping more affordable.

- Increased Sales: Businesses that use Afterpay often see increased sales. Customers are more likely to buy when they can pay later.

Integration

- Enhanced Offerings: Integrating Afterpay with Square and Cash App enhances Block Inc.’s product offerings.

- Broader Reach: Afterpay attracts a younger audience, expanding Block Inc.’s customer base.

Here is a table summarizing the role of Cash App and Afterpay:

| Growth Driver | Key Features | Benefits |

| Cash App | Easy money transfers, stock and Bitcoin investments, direct deposits | Attracts more users, adds convenience |

| Afterpay | Buy now, pay later | Increases sales, attracts younger audience |

Future Growth Strategies and Potential Challenges

Expansion Plans

- New Markets: Block Inc. plans to expand into new markets. This includes international markets where digital payments are growing.

- New Products: The company is always looking to innovate and add new products to its lineup.

Technological Advancements

- AI and Machine Learning: Block Inc. is investing in AI and machine learning to improve its services. This includes better fraud detection and personalized customer experiences.

Challenges

- Competition: The fintech industry is very competitive. Block Inc. must stay ahead of competitors like PayPal and Stripe.

- Regulatory Issues: As financial services evolve, new regulations can pose challenges. Block Inc. needs to navigate these carefully.

Here is a chart showing future growth strategies and potential challenges:

| Future Strategy | Description |

| Expansion Plans | Entering new markets, launching new products |

| Technological Advancements | Using AI and machine learning to enhance services |

| Potential Challenges | Facing strong competition, dealing with regulations |

Block Inc. is well-positioned for future growth. The popularity of Cash App and the addition of Afterpay are significant drivers. The company’s focus on innovation and expansion will help it navigate challenges and continue to grow.

Investing in SQ Stock: A Step-by-Step Guide

Investing in Block Inc. (SQ) stock can be a good idea. Here is a simple guide to help you get started in Fintechzoom SQ Stock.

Researching and Gathering Information

Learn About the Company

- Read Reports: Look at Block Inc.’s annual and quarterly reports. These reports show how the company is doing financially.

- News Updates: Stay updated with the latest news about Block Inc. This helps you understand any changes that might affect the stock.

Understand the Industry

- Fintech Trends: Learn about trends in the fintech industry. This helps you see how Block Inc. fits into the bigger picture.

Analyzing Financial Statements and Performance Metrics

Revenue and Profit

- Check Growth: Look at how Block Inc.’s revenue and profit have grown over time. Steady growth is a good sign.

- Profit Margins: Higher profit margins mean the company is making more money from its sales.

Earnings Reports

- Quarterly Results: Review the company’s quarterly earnings reports. These show how the company performs every three months.

- Analyst Opinions: Read what financial analysts say about Block Inc. Their insights can be helpful.

Here is a simple table summarizing key financial metrics to check:

| Financial Metric | What to Look For |

| Revenue Growth | Steady increase over time |

| Profit Margins | High and improving margins |

| Quarterly Earnings | Consistent and positive results |

| Analyst Opinions | Positive reviews and recommendations |

Considering Market Conditions and Industry Trends

Stock Market Trends

- General Market: Look at the overall stock market trends. A rising market can be a good time to invest.

- Fintech Sector: Pay attention to how the fintech sector is performing.

Economic Indicators

- Interest Rates: Changes in interest rates can affect stock prices. Low rates often lead to higher stock prices.

- Economic Health: A strong economy usually means better performance for stocks.

Choosing a Brokerage Platform and Opening an Account

Selecting a Brokerage

- Features: Look for a brokerage that offers good features, like low fees and easy-to-use platforms.

- Reputation: Choose a well-known and trusted brokerage.

Opening an Account

- Simple Process: Most brokerages have a simple online account opening process. Follow the steps to set up your account.

- Deposit Funds: Add money to your brokerage account to start investing.

Making Informed Investment Decisions

Buy SQ Stock

- Placing an Order: Use your brokerage account to buy SQ stock. You can place a market order (buy at the current price) or a limit order (buy at a specific price).

- Monitor Your Investment: Keep an eye on your investment. Check the stock price regularly and stay informed about the company.

Monitoring Stock Performance Regularly

Regular Reviews

- Check Performance: Regularly check how your SQ stock is performing. Compare it with your initial expectations.

- Stay Updated: Follow news and updates about Block Inc. This helps you make informed decisions about holding or selling your stock.

Adjusting Your Strategy

- Rebalance Portfolio: If needed, rebalance your investment portfolio to manage risk. This might mean selling some stocks and buying others.

Investing in Block Inc. (SQ) stock involves careful research, understanding financial metrics, considering market conditions, choosing the right brokerage, making informed decisions, and regularly monitoring your investment. Following these steps can help you invest wisely and manage your portfolio effectively.

Risks and Considerations

Investing in Block Inc. (SQ) stock can be rewarding, but it also comes with risks. Here are some important things to consider before you invest in Fintechzoom SQ Stock.

Potential Risks Associated with Investing in Fintech Stocks

Market Volatility

- Stock Price Fluctuations: Fintech stocks can be very volatile. This means the stock price can go up and down quickly.

- Economic Changes: Changes in the economy can affect fintech stocks. For example, a recession might lead to lower stock prices.

Competition

- Strong Competitors: Block Inc. competes with big companies like PayPal and Stripe. Strong competition can impact its market share and profits.

- Innovation Pressure: To stay ahead, Block Inc. must constantly innovate. This can be challenging and costly.

Regulatory Challenges

- Changing Regulations: The fintech industry is heavily regulated. New laws and regulations can affect how Block Inc. operates.

- Compliance Costs: Complying with regulations can be expensive and time-consuming.

Here is a table summarizing the potential risks:

| Risk Factor | Description |

| Market Volatility | Quick and unpredictable changes in stock price |

| Competition | Strong competitors affecting market share |

| Regulatory Challenges | Changing laws and compliance costs |

Market Volatility and Regulatory Challenges

Impact of Market Volatility

- Unpredictable Returns: The value of your investment can change quickly. This makes it hard to predict returns.

- Investment Horizon: Volatility is a bigger risk if you need to sell your stock soon. Long-term investors can often ride out short-term fluctuations.

Navigating Regulatory Challenges

- Staying Informed: Keep up with news about regulatory changes. Understanding these changes helps you assess their impact on Block Inc.

- Company Compliance: Check if Block Inc. is complying well with regulations. Companies that manage compliance well are generally safer investments.

Importance of Diversification in Investment Portfolios

Spreading Risk

- Multiple Investments: Don’t put all your money in one stock. Invest in different stocks to spread risk.

- Asset Classes: Consider other types of investments, like bonds or real estate. This reduces the impact of any single investment’s poor performance.

Balanced Portfolio

- Risk Management: A balanced portfolio helps manage risk. It can include stocks, bonds, and other assets.

- Stable Returns: Diversification can lead to more stable returns. It reduces the impact of volatility in any one investment.

Here is a simple chart showing the benefits of diversification:

| Benefit | Description |

| Spread Risk | Reduces impact of poor performance in one stock |

| Balanced Portfolio | Includes different types of investments |

| Stable Returns | Reduces the impact of poor performance in one stock |

In summary, while investing in Block Inc. (SQ) stock can offer good returns, it is important to understand and manage the risks. Market volatility, competition, and regulatory challenges are key factors to consider. Diversifying your investment portfolio can help mitigate these risks and lead to more stable returns.

Conclusion

Block Inc. (SQ) is a major player in the fintech industry, offering innovative products like Square, Cash App, and Afterpay. These products simplify payments and provide new financial solutions, making them popular with both businesses and consumers. Block Inc.’s growth is driven by its ability to innovate and adapt to market needs.

Investing in Block Inc. stock can be rewarding, but it also comes with risks. Market volatility, strong competition, and regulatory challenges are important factors to consider. Diversifying your investment portfolio can help manage these risks and lead to more stable returns.

FAQ for Fintechzoom SQ Stock

What is Block Inc. (SQ)?

Block Inc. (SQ) is a financial technology company that provides various payment and financial services. It is known for its popular products like Square, Cash App, and Afterpay.

What are the main products of Block Inc.?

The main products of Block Inc. include Square (a payment processing system for businesses), Cash App (a mobile payment and investing service), and Afterpay (a buy now, pay later service).

How does Cash App work?

Cash App allows users to send and receive money easily. It also lets users buy and sell stocks and Bitcoin. Users can also get their paychecks deposited directly into their Cash App account.

What is the significance of the Afterpay acquisition?

Afterpay lets customers buy now and pay later, making shopping more flexible. This acquisition helps Block Inc. expand its product offerings and reach a younger audience.

What are the risks of investing in Block Inc. stock?

Investing in Block Inc. stock involves risks such as market volatility, strong competition, and regulatory challenges. It’s important to consider these factors before investing.

How can I invest in Block Inc. stock?

To invest in Block Inc. stock, you need to research the company, analyze its financial statements, and consider market conditions. Then, choose a brokerage platform, open an account, and buy SQ stock.

Why is diversification important in investing?

Diversification is important because it spreads risk across different investments. This reduces the impact of poor performance in any single stock and leads to more stable returns.

What is the future outlook for Block Inc. (SQ)?

The future outlook for Block Inc. (SQ) is positive due to its continuous innovation and expansion into new markets. The popularity of Cash App and the acquisition of Afterpay are expected to drive future growth.

Can you explain the Afterpay acquisition?

The Afterpay acquisition allows Block Inc. to offer a “buy now, pay later” service. This acquisition is significant because it expands Block Inc.’s product offerings and attracts a younger, tech-savvy audience.

I am David seasoned content writer, excels in crafting engaging, SEO-optimized content across diverse industries, driving engagement and results.