Car insurance in Dubai covers damage to your car caused by unexpected rain. It helps pay for repairs if heavy rain leads to accidents or other damage.

In Dubai car insurance can protect your vehicle on rainy days. When it rains accidents and damages are more likely. Insurance helps cover the cost of repairs from related rain damage. Make sure your policy includes coverage for weather events like rain.

Did a sudden downpour in Dubai leave your car damaged? Discover how the right car insurance can turn your rainy day around.

- Financial Loss from Rain Related Accidents in Dubai

- Steps to Take After Rain Damage

- Insurance Claim Process after Rain Damage

- Tips for Successful Insurance Claims

- Resolving Disputes with Sanatak UAE

- Important Concerns for Insurance Disputes

- Encouraging Awareness among UAE Residents

- Conclusion

- Frequently asked questions about car insurance after Dubai rain

Financial Loss from Rain Related Accidents in Dubai

Rainy weather increases the number of car accidents in Dubai leading to significant financial losses. Many drivers face high costs for repairing their damaged vehicles after such incidents. This strain on funds can be mitigated by having exhaustive vehicle protection that covers related downpour harms.

The expense of these fixes can rapidly add up particularly on the off chance that parts should be imported or concentrated work is required. For the vast majority occupants these unforeseen costs can disturb financial plans and investment funds and making it critical to keep up with protection that explicitly addresses the dangers related with weighty precipitation.

Rain impact on Driving and Vehicle Safety

During rain roads in Dubai become elusive and visibility drops which makes driving circumstances unsafe. These difficult circumstances significantly improve the probability of mishaps. Appropriate vehicle support and mindful driving are fundamental in forestalling disasters during wet climate.

Rain can likewise make harm a vehicle’s electrical frameworks and inside on the off chance that water figures out how to leak inside. Guaranteeing your vehicle is very much kept up with and that your Car insurance contract covers such harms can assist with moderating these dangers. It is additionally essential to follow traffic warnings during weighty downpours to guarantee wellbeing.

Steps to Take After Rain Damage

If rain damages your car in Dubai the first thing to do is document the damage. Take clear photos of your car from different angles to show all the damage. These photos are important for filing your Car insurance claim.

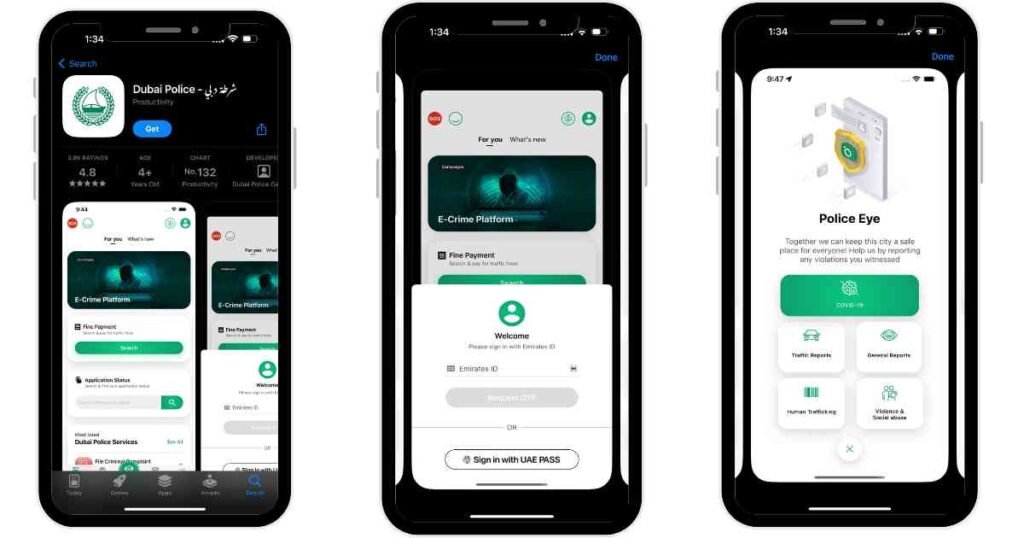

Next report the damage to the Dubai Police through their app or website. They will review your case and can issue a To Whom It May Concern certificate. This certificate is necessary for your Car insurance claim process.

Documentation and Reporting for Insurance Claims

After reporting to the police and gather all your documents including the police certificate, photos of the damage and your insurance policy details. This paperwork is essential for submitting your insurance claim. Ensure everything is coordinated and finish to keep away from delays.

The demand for professional paint services in Dubai is consistently high due to the city’s vibrant real estate market, continuous construction projects, and the desire for aesthetic enhancements in both residential and commercial properties. Here are some of the key paint services available in Dubai.

Submit your claim to your insurance agency as quickly as time permits. The sooner you report the harm the speedier you can find support. Quick activity is vital to sorting your vehicle out and back out and about rapidly.

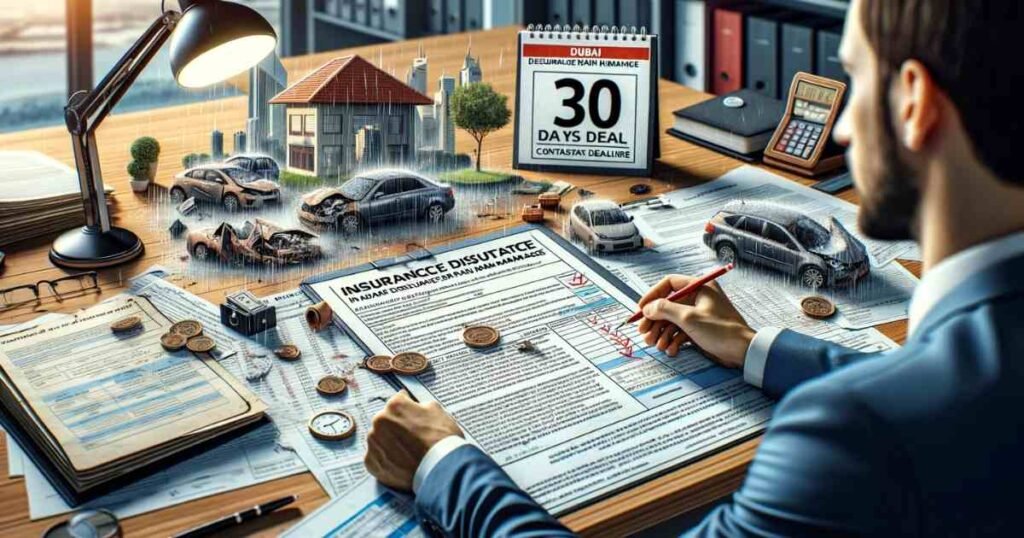

Insurance Claim Process after Rain Damage

At the point when you really want to record a protection guarantee for rain damage in Dubai begin by presenting all your assembled archives to your protection supplier. This includes your damage photos to the police certificate and your Car insurance details. Having complete and clear documentation helps speed up the claim process. In the event that your vehicle was left and got overwhelmed in a parking area, the protection will probably cover the towing and support costs.

Guarantee that you finish up all vital structures accurately and submit them instantly. Know that in the event that the vehicle was left in a waterlogged region and you attempted to turn over an overwhelmed motor this could prompt claim denial as expressed by Moin ur Rehman. Ideal entries are significant for a smooth case endorsement process.

Tips for Successful Insurance Claims

To work on your possibilities of an effective protection guarantee, twofold check that all data gave is precise and complete. Botches or missing subtleties can postpone your case or even lead to a disavowal. Being thorough and precise is crucial.

Understand your insurance policy’s terms regarding rain damage. If your car is towed from a flooded area for maintenance, it’s usually covered. However, attempting to start a submerged engine can result in claim rejection. Always check with your Car insurance agent to clarify any confusing parts of your policy regarding what actions might affect your claim.

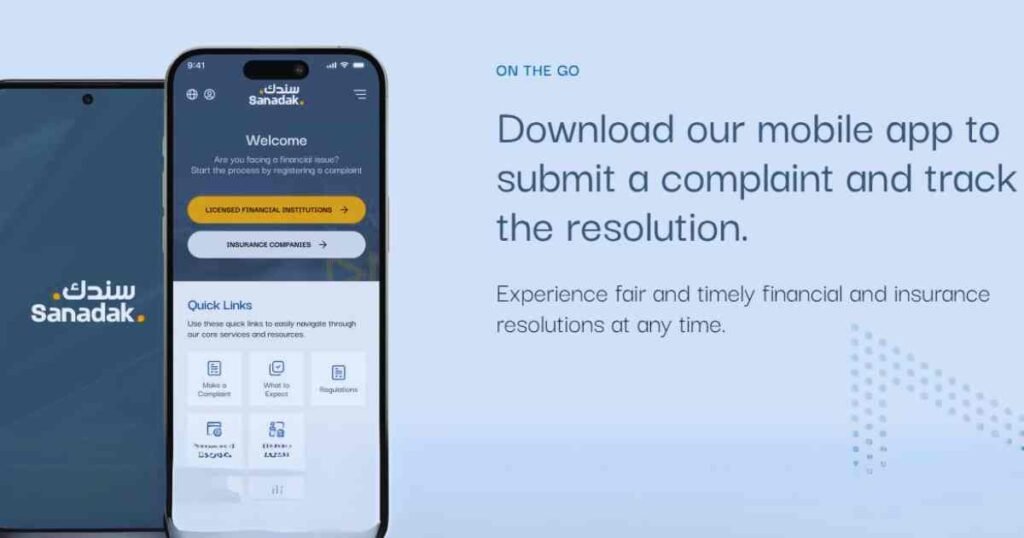

Resolving Disputes with Sanatak UAE

If you have a disagreement with your insurance company about a claim after rain damage, Sanatak UAE can help. This organization specializes in resolving banking and insurance disputes quickly. You can use the Sanatak app to submit your grievance and expect a resolution within 5 working days.

Sanatak UAE provides a straightforward process for dispute resolution. Just upload all the necessary documents and details of your claim through their app. Their efficient approach ensures that your case is handled promptly, helping you resolve any issues with minimal stress.

Using Sanatak UAE’s Services Effectively

To use Sanatak UAE’s services and make sure to file your dispute within 30 days of the issue arising. This timeframe is crucial for receiving assistance. By acting quickly you can take full advantage of their resources and expertise in dispute resolution.

Encourage other UAE residents to be aware of Sanatak UAE and its benefits. Sharing this information can assist more individuals with understanding their choices for settling protection debates really. This is particularly valuable for those new to the interaction to guaranteeing they get the help they need during distressing times.

Important Concerns for Insurance Disputes

While managing protection questions in Dubai, particularly after rain damage and it is vital to rapidly act. You have 30 days from the day the dispute arises to seek help from Sanatak UAE. Starting the resolution process within this time frame is crucial for effective assistance.

Ensure all your documentation is finished and precise prior to presenting a debate. This incorporates your insurance contract subtleties, any correspondence with the insurance agency, and proof of the harm and fix statements. Legitimate documentation upholds your case and improves the probability of a good goal.

Encouraging Awareness among UAE Residents

It is advantageous for all UAE residents to comprehend their privileges and the assets accessible for settling insurance disputes. Sharing information about services like Sanatak UAE can empower more people to handle their insurance issues confidently.

Teaching loved ones about how to appropriately document questions and the significance of ideal activity can forestall difficulties. This information is priceless for proficiently dealing with the frequently intricate course of protection claims and questions.

Conclusion

To effectively handle car insurance claims related to rain damage in Dubai it is essential to be prepared and knowledgeable. Document any damage thoroughly, understand your insurance coverage and submit your claims promptly to ensure the best outcomes. Quick and accurate action can help mitigate the financial impact of rain damage on your vehicle.

Sharing insights and information about managing car insurance claims and understanding the role of organizations like Sanatak UAE in resolving disputes can empower more residents in Dubai. This knowledge ensures that everyone is better equipped to deal with the challenges of unexpected weather and keeping their cars protected and their minds at ease.

Frequently asked questions about car insurance after Dubai rain

Is flood covered by car insurance in the UAE?

Indeed flood harm is normally covered by complete vehicle insurance contracts in the UAE. Be that as it may, it is vital to check your particular approach subtleties as inclusion can change.

Does insurance cover natural disasters in the UAE?

Indeed most far reaching vehicle insurance contracts in the UAE cause cover harm brought about by catastrophic events, including floods, storms and earthquakes.

What happens if you drive without insurance in Dubai?

Driving without protection in Dubai is unlawful. On the off chance that got you can confront strong fines vehicle impoundment and, surprisingly, legitimate activity.

Is car insurance mandatory in Dubai?

Indeed vehicle protection is compulsory in Dubai. Each vehicle out and about should host essentially a fundamental third party responsibility insurance contract.

Is there a grace period for car insurance in Dubai?

Indeed there is normally a multi month beauty period for vehicle protection in Dubai. This incorporates the standard a year of inclusion in addition to an extra month to consider recharging without a slip by in inclusion.

I am David seasoned content writer, excels in crafting engaging, SEO-optimized content across diverse industries, driving engagement and results.